Bed and Breakfast for Sale Santo Antonio das Areias, R de Santo Antonio

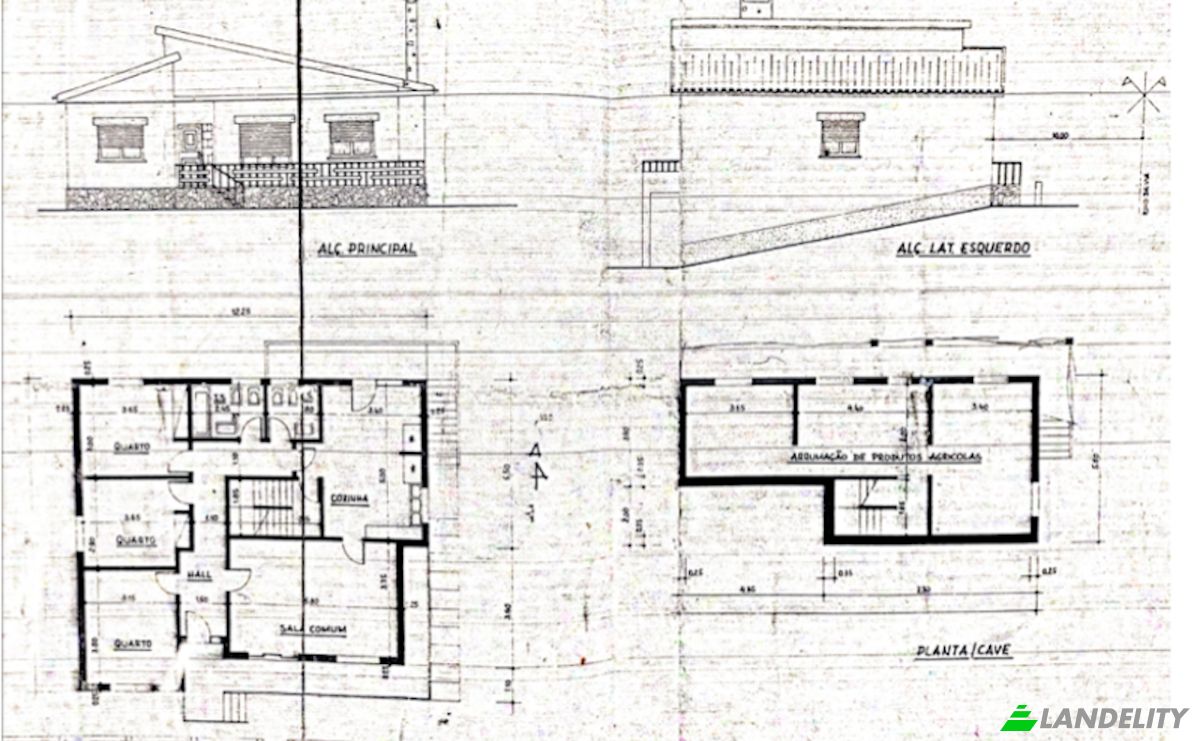

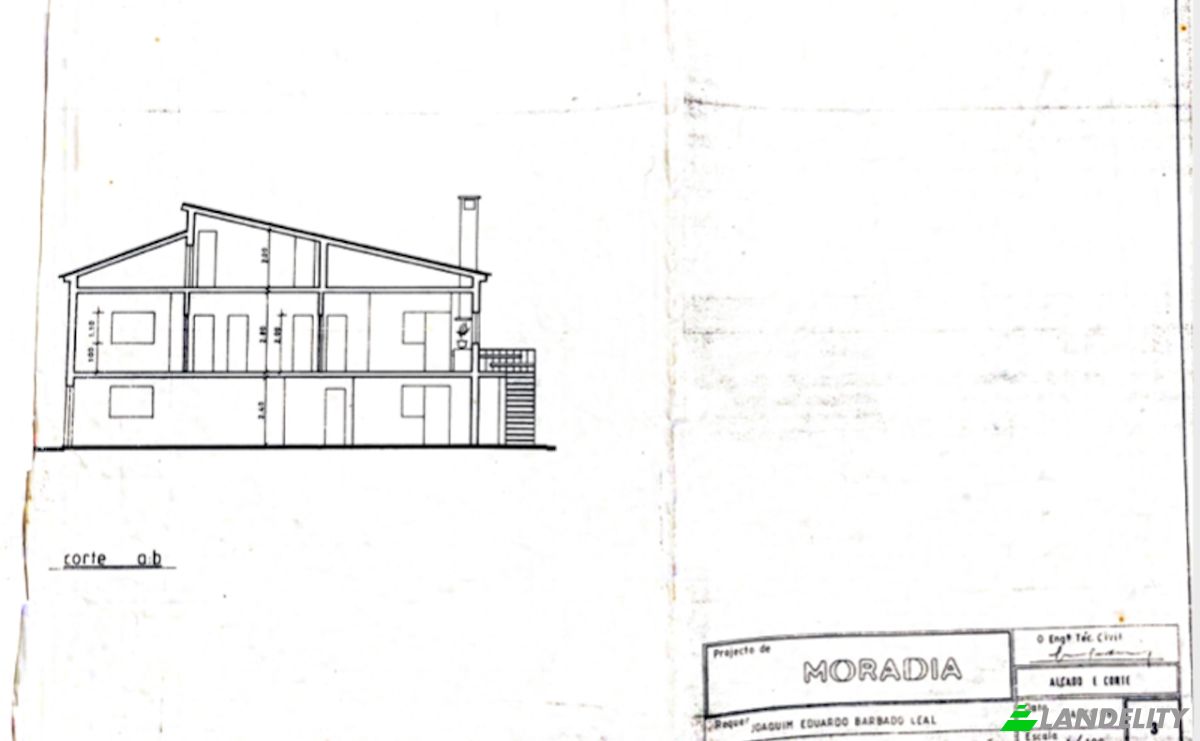

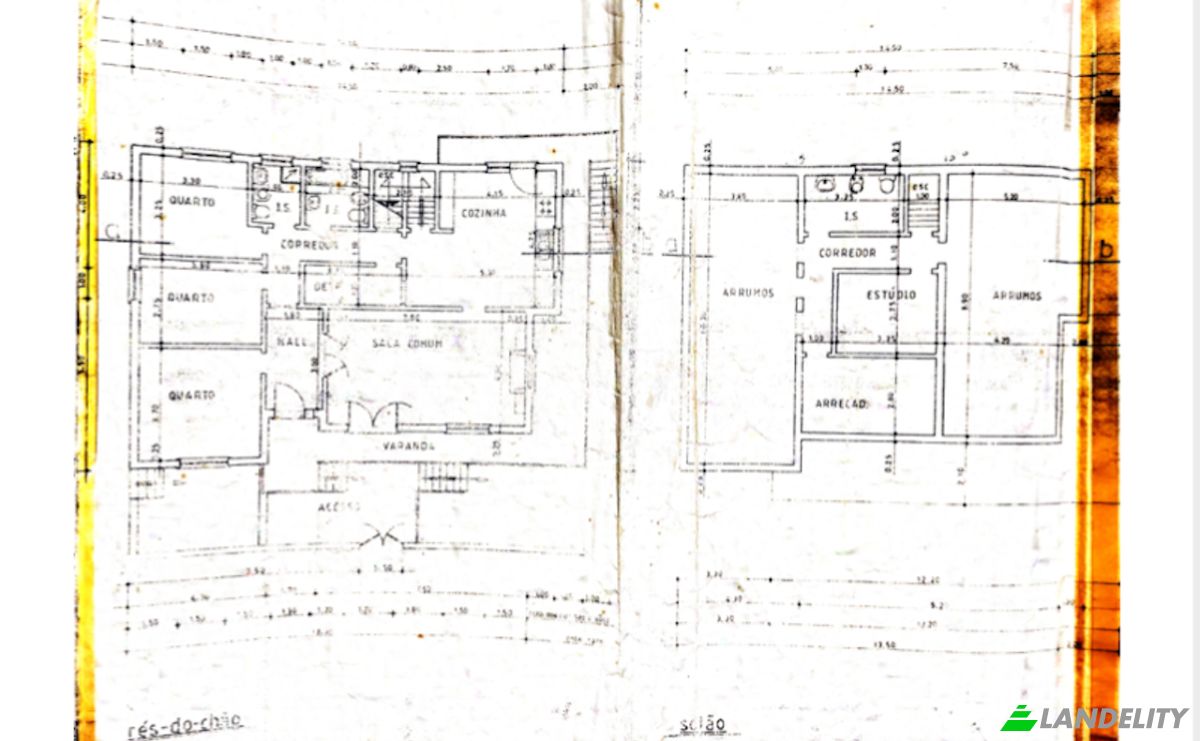

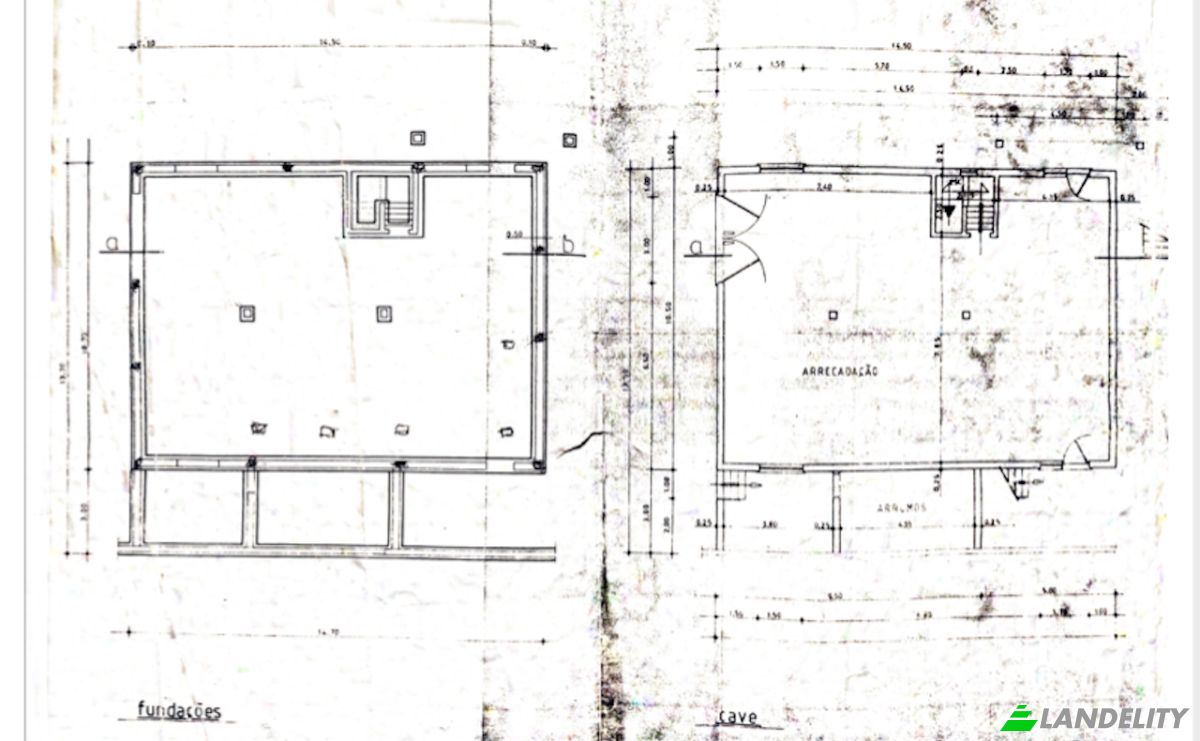

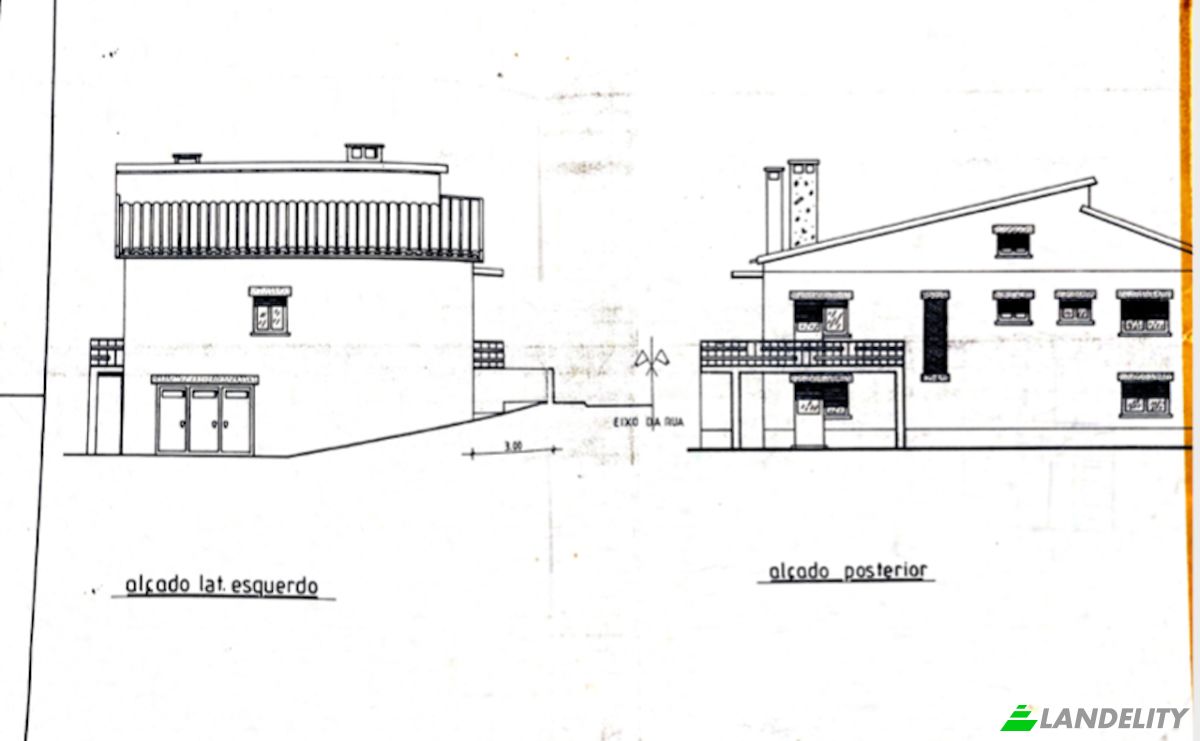

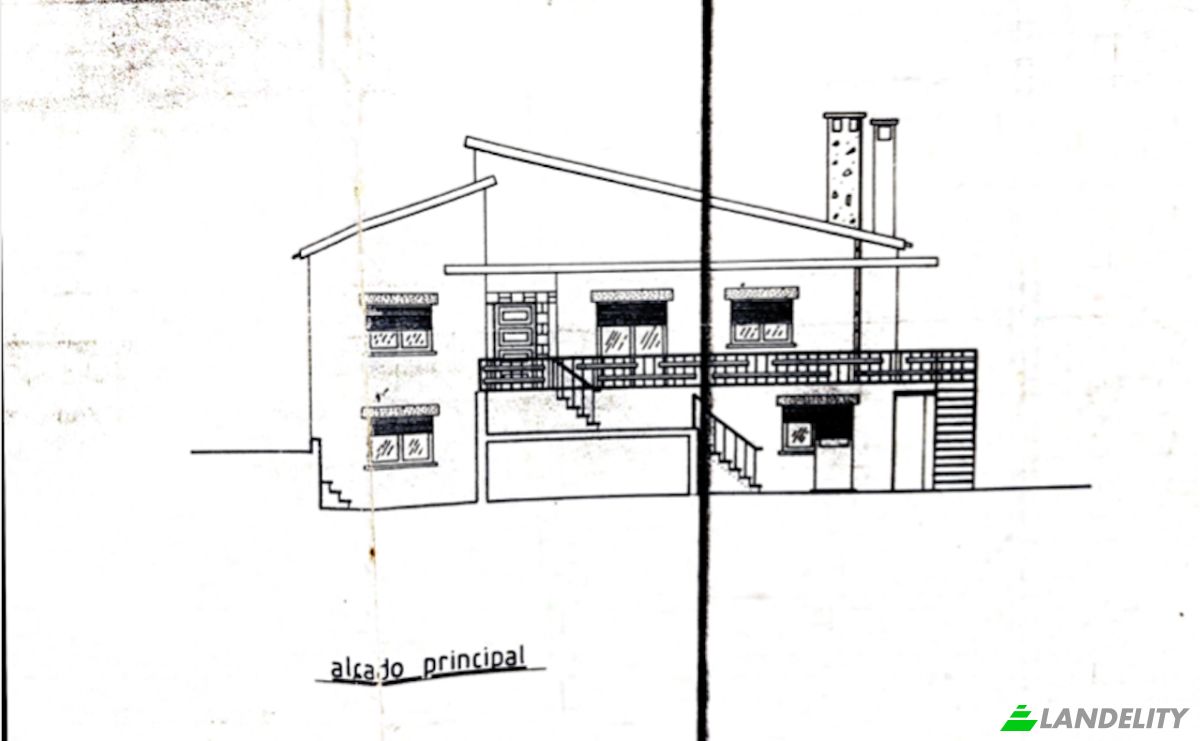

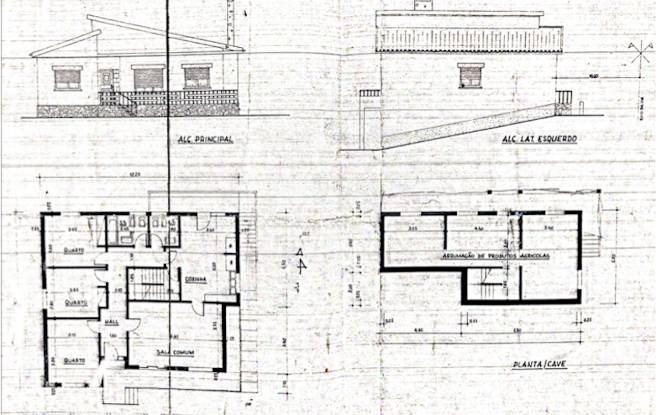

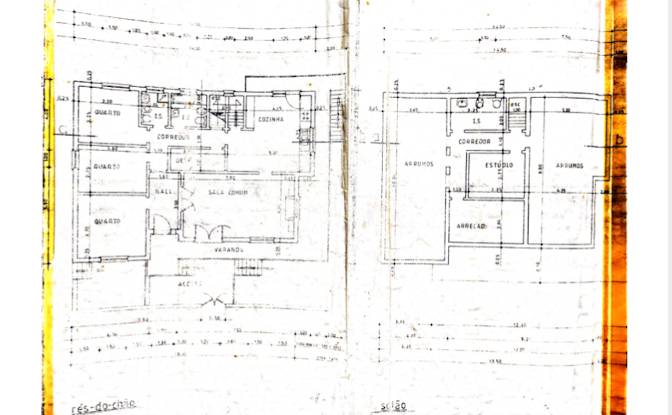

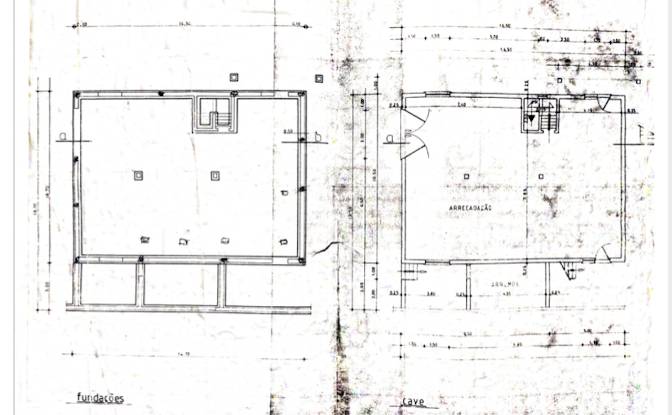

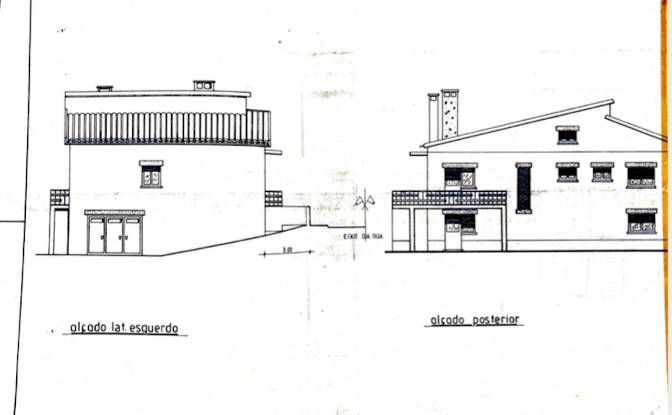

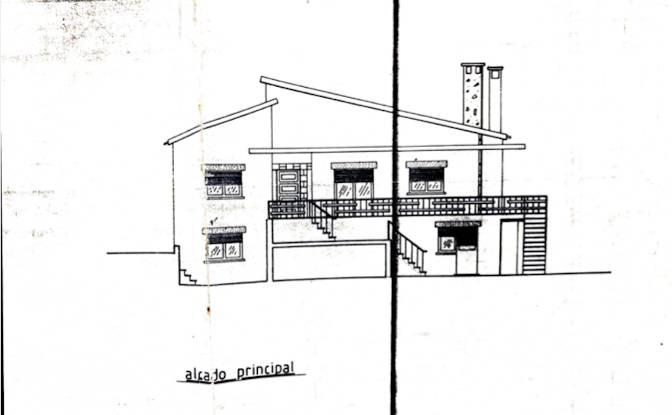

Charming Villa in Marvão – Casa das Águias* Where history becomes opportunity Dreaming of launching your own boutique B&B? This spacious three-storey villa in the heart of Serra de São Mamede Natural Park offers both lifestyle and investment potential. Highlights: - 5 bedrooms | 4 bathrooms | 2 fully equipped kitchens - Optionally sold fully furnished - Private garage, indoor bar & outdoor BBQ area - Panoramic views over the Alentejo plains and into Spain Why invest? - Flexible layout: divide into two independent rental units - Strong tourism demand: Marvão is one of Portugal’s most visited medieval villages - Growing market: wellness retreats & sustainable tourism in Alentejo - Attractive price – rare entry into Portugal’s rural luxury market Investor Advantage At €460,000, this property offers entry into the luxury rural market at an accessible price point, combining lifestyle enjoyment with solid investment fundamentals. With Portugal’s reputation for safety, stability, and growing tourism, international investors can expect long‑term appreciation and reliable rental yields. ROI Potential * Guest House Conversion: With 5 bedrooms, 4 bathrooms, and 2 kitchens, the property can be adapted into a boutique Guest House with 6–8 rentable units. * Average Daily Rate (ADR) in rural Portugal: €80–€120 per room (depending on season and amenities). * Occupancy Rate: Rural tourism in Alentejo averages 55–70% annually. * Projected Gross Revenue: * At €100 ADR × 6 rooms × 60% occupancy → ~€131,400 per year. * At €120 ADR × 8 rooms × 70% occupancy → ~€245,280 per year. * ROI Estimate: Between 12–18% annually, depending on management efficiency and marketing strategy. Risk Analysis * Market Risk: Tourism demand can fluctuate with economic cycles, but Portugal’s rural tourism sector has shown steady growth. * Seasonality: Higher occupancy in spring/summer; lower in winter. Diversifying with cultural events and cross‑border Spanish visitors mitigates this. * Operational Risk: Requires professional management, licensing, and marketing to achieve target occupancy. * Regulatory Risk: Compliance with local hospitality laws and guest house licensing is essential. * Currency Risk: For international investors, euro fluctuations may impact returns when converted to home currency. Financial Plan (at request) Initial Investment: €460,000 (purchase price, furniture included). Conversion Costs: €40,000–€60,000 (minor renovations, branding, licensing, marketing setup). Total Capital Outlay: ~€500,000. Revenue Streams: * Guest House nightly stays * Vacation rentals (Airbnb/Booking.com) * Event hosting (small retreats, cultural stays) Operating Costs (annual): * Staff & management: €40,000–€60,000 * Utilities & maintenance: €15,000–€20,000 * Marketing & booking fees: €10,000–€15,000 Net Operating Income (NOI): * Conservative scenario: ~€60,000–€80,000 per year * Optimistic scenario: ~€120,000–€150,000 per year Payback Period: 4–7 years depending on occupancy and pricing strategy. Casa das Águias is your chance to blend history, comfort, and profitability. Marvão, Portugal – a timeless destination with modern opportunity. Youtube Video: https://www.youtube.com/watch?v=Gey2ixiX6eY&t=3s